Saving as an expat PhD Student in France

After ignoring the issue for a bit too long, in 2023 I have started studying personal finance to understand where to allocate my savings and how to build a portfolio for my objectives. I’ll be honest, it didn’t take too much effort for me because I immediately got interested in the topic and I found it very entertaining to learn about economics and finance, since my previous knowledge was vague to say the least.

I wanted an absolutely rational and passive approach, so after evaluating my strategy for a while, I have then decided to invest an initial lump sum on an all country world ETF (yes, it’s probably the one you’re thinking about). With time I reallocated all my savings from old Poste Italiane coupons to stick to my strategy. The fact that I had all my savings (not much, mind you) in Poste Italiane is the symptom of my ignorance in finance and of too much trust in my parents.

A year passed and even if I have been in France for a while now, only after I started my PhD I have been interested to figure out the taxation on capital gains here, and I found out it was even worse than in Italy. Your account with an online broker is considered a CTO (Compte Titre Ordinaire), and as of now the capital gains on stocks and stock ETFs sold with this investment wrapper are taxed at a fixed rate of 30%. But if you’re a long term investor, the best tax-efficient investment wrapper for you is a “PEA”, Plan d’Epargne en Action. With this wrapper, if you hold investments for more than 5 years, the 12.8% income tax disappears and it just leaves a 17.2% social contribution tax. Great no? Not really, since very few ETFs are eligible for PEA and they have a higher TER. For example the only eligible ETF tracking the MSCI World index is the Amundi MSCI World UCITS ETF EUR (CW8) which has a 0.38% TER p.a., while the classic iShares Core MSCI World UCITS ETF (IWDA) has a TER of 0.20% p.a. If you want to track emerging markets, well… you can’t. At least not without a lot of work. With PEA you also have higher fees, for example some banks have fees to open the account, to close it, running costs and higher fees to buy the ETFs compared to online brokers.

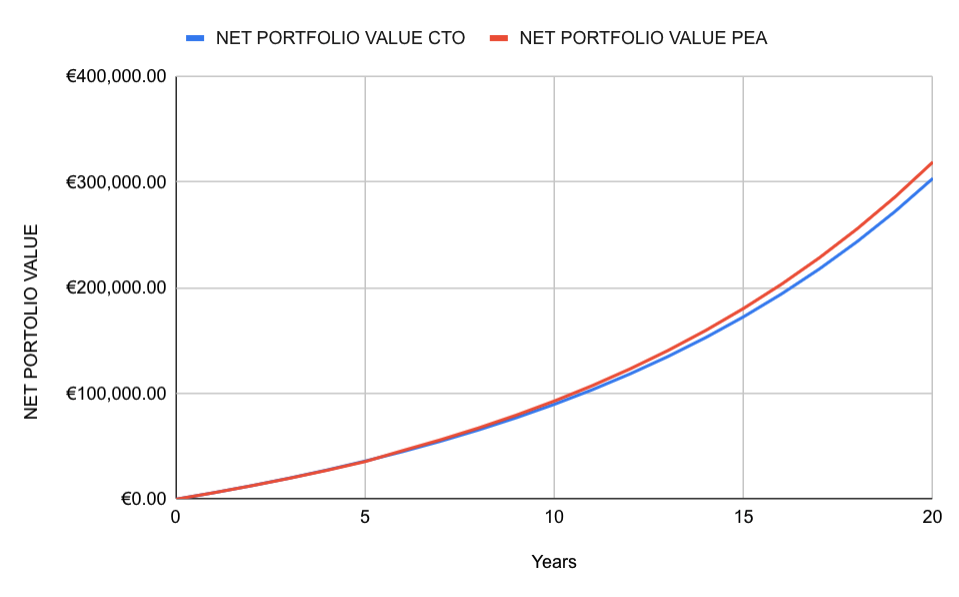

After this dive into the French savings system I wanted to figure out if that is really worth it in the long term, especially if I wanted to move back to Italy (unlikely) or go in some other country after the end of my PhD. I opened a speadsheet and I started writing down some numbers. I have taken the costs of the cheapest PEA and the average yearly return of IWDA and CW8 into account, their TER, and after about an hour I had the first graph.

The graph shows how much money I would have in my pocket if I had sold everything at any point in time in a 20-years span. Even if not as big as 12.8%, difference is there, the final net portfolio value of the PEA is about 5% higher than the CTO.

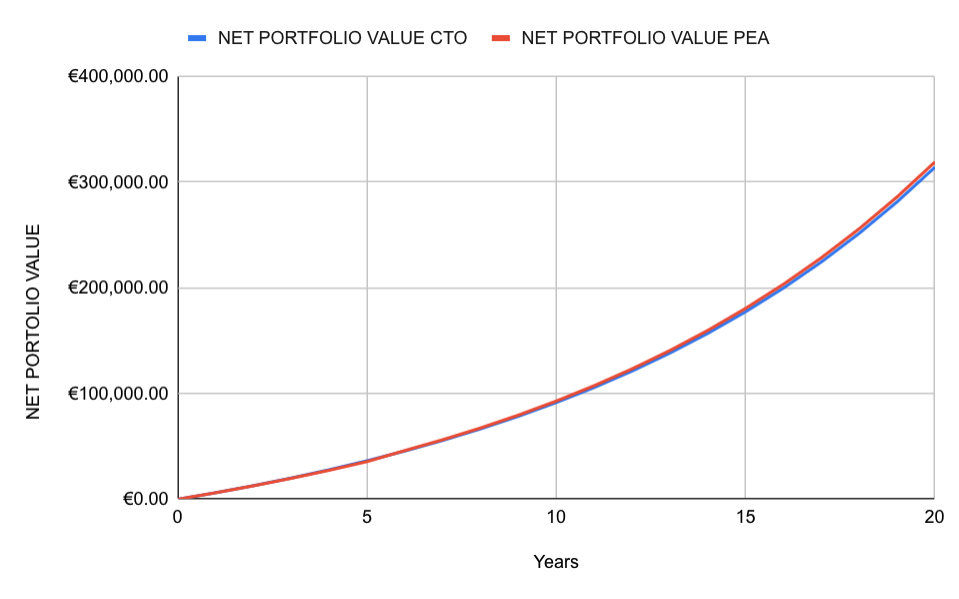

But what if my future is not in France? If I move my portfolio to a PEA, I will be stuck for 5 years in France if I want to avoid a 30% capital gain tax, and that’s not very fun. What would be the graph then, considering the taxation of another state? Let’s take Italy for example. With a capital gain tax of 26% this would be the graph.

The difference now is pretty negligible, the PEA’s net portfolio value would be only 1.57% higher than with an online broker, which considering the risk of moving abroad before the next 5 years, definitely makes me opt to keep my assets in my online broker portfolio.

You can find the speadsheet I used here. Feel free to play with it and please let me know if I made any mistake!